How Do You Pay a Home Equity Loan Back? A Comprehensive Guide to Repayment Strategies

Guide or Summary:Understanding Home Equity LoansRepayment Terms and StructureMonthly Payment CalculationStrategies for RepaymentPotential Risks and Consider……

Guide or Summary:

- Understanding Home Equity Loans

- Repayment Terms and Structure

- Monthly Payment Calculation

- Strategies for Repayment

- Potential Risks and Considerations

**Translation of "how do you pay a home equity loan back":** How do you pay a home equity loan back

---

Understanding Home Equity Loans

A home equity loan allows homeowners to borrow against the equity they have built in their property. This type of loan is often used for major expenses such as home renovations, education, or debt consolidation. However, once you take out a home equity loan, a critical question arises: **how do you pay a home equity loan back**? Understanding the repayment process is essential to managing your finances effectively and avoiding potential pitfalls.

Repayment Terms and Structure

Home equity loans typically come with fixed interest rates and set repayment terms, often ranging from 5 to 30 years. The repayment structure usually involves monthly payments that cover both the principal and interest. Knowing the terms of your loan will help you plan your budget and ensure timely payments.

Monthly Payment Calculation

To determine how much you need to pay monthly, you can use a loan calculator or consult your lender for an amortization schedule. This schedule will outline how much of each payment goes toward the principal and how much goes toward interest. Understanding this breakdown is crucial for financial planning and ensuring you can meet your obligations.

Strategies for Repayment

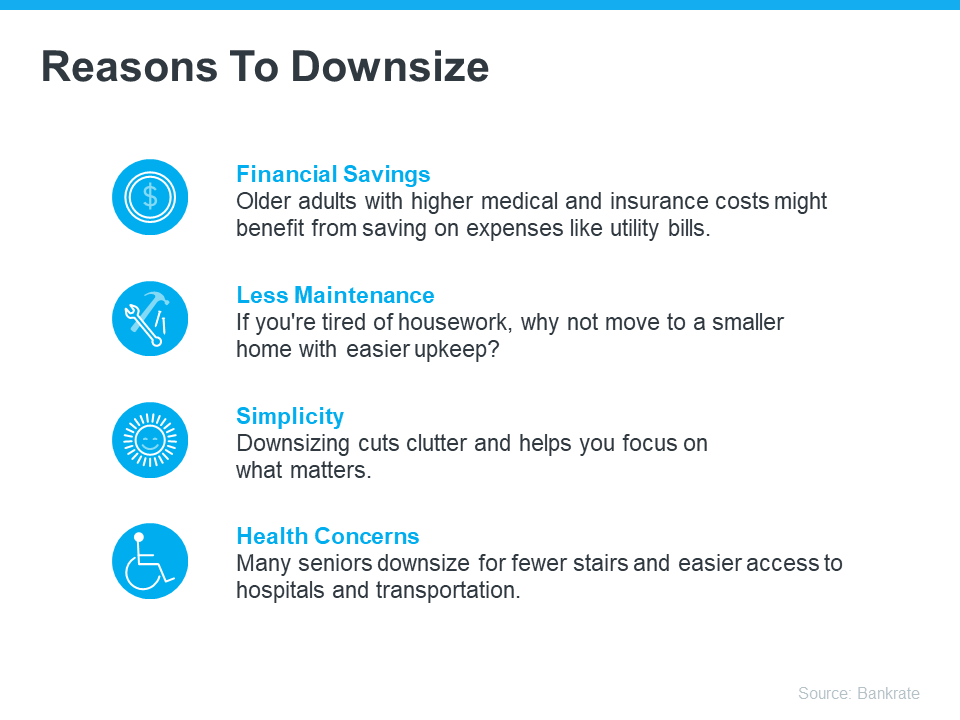

When considering **how do you pay a home equity loan back**, several strategies can help you manage your payments effectively:

1. **Set Up Automatic Payments**: Automating your payments can help you avoid late fees and keep your credit score intact. This method ensures that your payment is deducted from your bank account on a set date each month.

2. **Create a Budget**: Incorporating your home equity loan payments into your monthly budget can help you manage your finances better. Track your income and expenses to identify areas where you can cut back and allocate more funds toward your loan repayment.

3. **Make Extra Payments When Possible**: If you find yourself with extra cash, consider making additional payments toward your home equity loan. This can reduce the principal balance and save you money on interest in the long run.

4. **Refinancing Options**: If you’re struggling with high-interest rates, you might explore refinancing your home equity loan. This could potentially lower your monthly payments and interest rate, making it easier to manage your repayment.

Potential Risks and Considerations

It’s important to understand the risks associated with home equity loans. Defaulting on your loan can lead to foreclosure, as your home is used as collateral. Always ensure that you have a solid repayment plan in place before taking out a loan.

In conclusion, understanding **how do you pay a home equity loan back** is crucial for any homeowner considering this type of financing. By familiarizing yourself with the loan terms, employing effective repayment strategies, and being aware of the potential risks, you can manage your home equity loan effectively and maintain your financial health. Always consult with a financial advisor if you have questions or need personalized advice tailored to your specific situation.