How to Get a Car Loan from a Credit Union: Your Ultimate Guide to Affordable Financing

Guide or Summary:Understanding Credit UnionsBenefits of Getting a Car Loan from a Credit UnionSteps to Get a Car Loan from a Credit UnionTips for Getting th……

Guide or Summary:

- Understanding Credit Unions

- Benefits of Getting a Car Loan from a Credit Union

- Steps to Get a Car Loan from a Credit Union

- Tips for Getting the Best Car Loan from a Credit Union

When it comes to purchasing a vehicle, securing a car loan can often feel like a daunting task. However, one of the best options available to you is obtaining a car loan from a credit union. In this comprehensive guide, we will explore how to get a car loan from a credit union, highlighting the benefits, the process, and tips to ensure you get the best deal possible.

Understanding Credit Unions

Credit unions are member-owned financial institutions that provide a variety of financial services, including car loans. Unlike traditional banks, credit unions typically offer lower interest rates and more personalized service, making them an attractive option for financing a vehicle. Because they are non-profit organizations, credit unions often pass their savings onto their members in the form of lower fees and better loan terms.

Benefits of Getting a Car Loan from a Credit Union

1. **Lower Interest Rates**: One of the most significant advantages of obtaining a car loan from a credit union is the lower interest rates compared to banks. This can save you a substantial amount over the life of your loan.

2. **Flexible Terms**: Credit unions often provide more flexible loan terms, allowing you to choose a repayment plan that fits your budget and financial situation.

3. **Personalized Service**: As member-focused institutions, credit unions tend to offer more personalized customer service. This can make the loan application process smoother and more efficient.

4. **Community Focus**: Many credit unions have a strong community focus, which can provide you with a sense of belonging and support throughout your financial journey.

Steps to Get a Car Loan from a Credit Union

1. **Research and Choose a Credit Union**: Start by researching local credit unions to find one that meets your needs. Look for one that offers competitive interest rates and favorable loan terms.

2. **Check Your Credit Score**: Before applying for a loan, check your credit score. A higher score can help you qualify for better rates. If your score needs improvement, consider taking steps to boost it before applying.

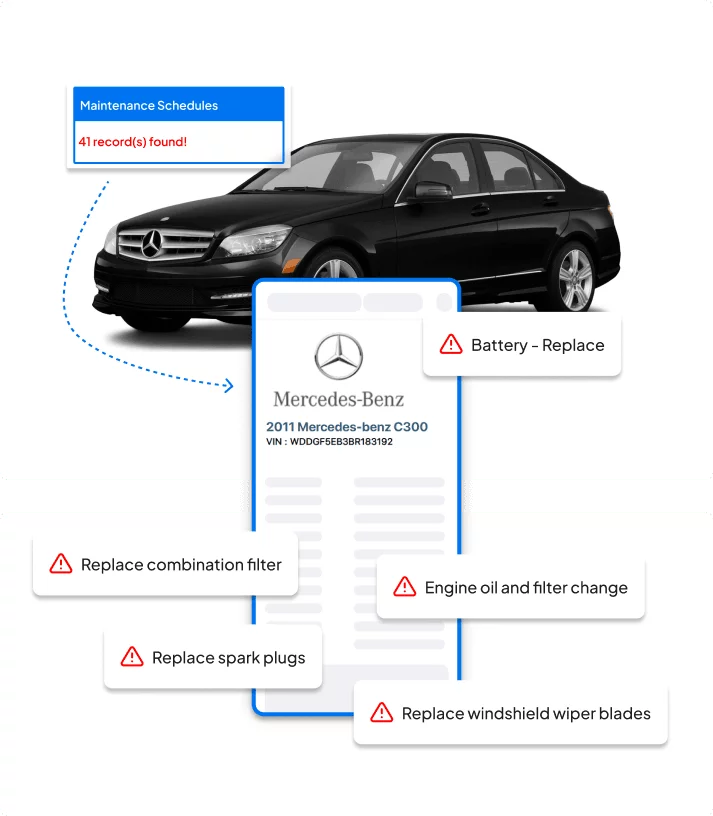

3. **Gather Necessary Documents**: Prepare the required documentation, which typically includes proof of income, identification, and information about the vehicle you wish to purchase.

4. **Apply for Pre-Approval**: Many credit unions offer pre-approval for loans, which can give you a better idea of how much you can borrow and at what interest rate. This step can also streamline the purchasing process.

5. **Find Your Vehicle**: Once pre-approved, start shopping for your vehicle. Knowing your budget will help you make informed decisions and avoid overspending.

6. **Complete the Loan Application**: After selecting your vehicle, complete the loan application process with your credit union. Be prepared to provide the necessary documentation and information about the vehicle.

7. **Review Loan Terms**: Carefully review the loan terms before signing. Ensure you understand the interest rate, repayment schedule, and any fees associated with the loan.

8. **Finalize the Loan**: Once you agree to the terms, finalize the loan with your credit union. They will provide you with the funds to purchase your vehicle.

Tips for Getting the Best Car Loan from a Credit Union

- **Negotiate Terms**: Don't hesitate to negotiate the terms of your loan. Credit unions may be willing to work with you to find a solution that fits your needs.

- **Consider Additional Products**: Some credit unions offer additional products, such as gap insurance or extended warranties, which can provide added peace of mind.

- **Stay Informed**: Keep an eye on market trends and interest rates. Being informed can help you make better decisions regarding your loan.

In conclusion, getting a car loan from a credit union can be a smart financial decision. By following the steps outlined in this guide, you'll be well on your way to securing an affordable car loan that meets your needs. Remember, the key to a successful loan application is preparation and research, so take your time to find the best credit union for your financial situation.