Unlock Your Financial Freedom with Emm Loans: The Ultimate Guide to Affordable Borrowing

Guide or Summary:Understanding Emm LoansWhy Choose Emm Loans?Types of Emm Loans AvailableHow to Apply for Emm LoansBenefits of Emm Loans---Understanding Emm……

Guide or Summary:

- Understanding Emm Loans

- Why Choose Emm Loans?

- Types of Emm Loans Available

- How to Apply for Emm Loans

- Benefits of Emm Loans

---

Understanding Emm Loans

Emm loans are designed to provide individuals with the financial support they need when unexpected expenses arise or when they want to make a significant investment. These loans are particularly appealing due to their flexible terms and competitive interest rates. Whether you're looking to consolidate debt, finance a home renovation, or cover medical expenses, Emm loans can be a viable solution.

Why Choose Emm Loans?

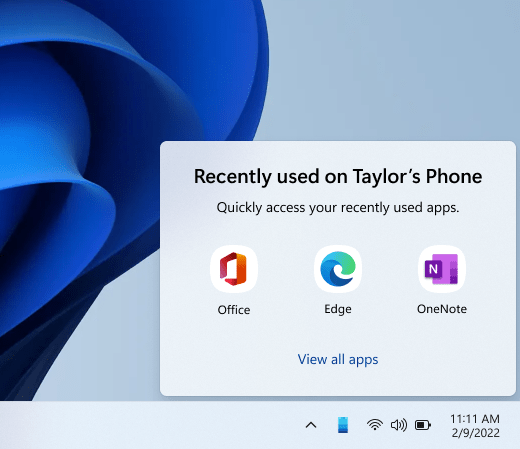

When considering your borrowing options, Emm loans stand out for several reasons. First and foremost, they offer a streamlined application process that can often be completed online. This convenience allows borrowers to access funds quickly, which is crucial in emergencies. Additionally, Emm loans typically have lower interest rates compared to credit cards and other personal loans, making them a more affordable choice in the long run.

Types of Emm Loans Available

Emm loans come in various forms to cater to different financial needs. Here are some common types:

1. **Personal Loans**: These are unsecured loans that can be used for any purpose, from debt consolidation to travel expenses. Personal loans from Emm are often available in varying amounts and repayment terms.

2. **Home Improvement Loans**: If you're looking to enhance your living space, Emm offers specific loans tailored for home renovations. These loans can help you finance major projects without draining your savings.

3. **Debt Consolidation Loans**: If you're struggling with multiple debts, an Emm debt consolidation loan can simplify your finances. By combining several debts into one loan with a lower interest rate, you can save money and make payments more manageable.

4. **Medical Loans**: Unexpected medical expenses can be overwhelming. Emm loans can help cover these costs, allowing you to focus on recovery without the added stress of financial burdens.

How to Apply for Emm Loans

Applying for Emm loans is a straightforward process. Here’s a step-by-step guide:

1. **Research**: Start by researching the different types of Emm loans available and determine which one best suits your needs.

2. **Check Your Credit Score**: Your credit score will play a significant role in the interest rates and terms you qualify for. Knowing your score can help you understand your borrowing power.

3. **Gather Documentation**: Prepare necessary documents such as proof of income, identification, and any other relevant financial information.

4. **Fill Out the Application**: Complete the online application form provided by Emm. Ensure that all information is accurate to avoid delays.

5. **Review Offers**: Once your application is submitted, you will receive loan offers. Take the time to compare interest rates, terms, and fees before making a decision.

6. **Accept the Loan**: After reviewing your options, you can accept the loan that best fits your financial situation. Funds are typically disbursed quickly, allowing you to access the money you need.

Benefits of Emm Loans

Choosing Emm loans comes with numerous benefits:

- **Flexibility**: Emm loans offer flexible repayment terms, allowing you to choose a plan that fits your budget.

- **Quick Access to Funds**: With a user-friendly application process, you can receive funds in as little as 24 hours.

- **No Hidden Fees**: Emm is transparent about fees, ensuring you know exactly what you’re paying for.

- **Dedicated Customer Support**: Emm provides excellent customer service to assist you throughout the borrowing process.

In conclusion, Emm loans are an excellent option for those seeking financial assistance. With a variety of loan types, competitive rates, and a straightforward application process, Emm loans can help you achieve your financial goals. Whether you need to cover unexpected expenses or invest in a significant project, consider Emm loans as your go-to solution for affordable borrowing. Take control of your finances today and explore the possibilities with Emm loans!