Unlock Quick Cash Solutions with Neighborhood Title Loans: Your Local Financing Option

Guide or Summary:Neighborhood Title Loans are becoming an increasingly popular choice for individuals seeking fast financial assistance. Whether you're faci……

Guide or Summary:

- Neighborhood Title Loans are becoming an increasingly popular choice for individuals seeking fast financial assistance. Whether you're facing unexpected expenses, medical bills, or urgent home repairs, these loans provide a viable solution that allows you to leverage the value of your vehicle while retaining its use. This comprehensive guide will delve into the benefits, application process, and considerations of neighborhood title loans to help you make an informed decision.

- Neighborhood title loans are secured loans that use your vehicle's title as collateral. This means that you can borrow a sum of money based on the equity of your car, truck, or motorcycle. The amount you can borrow typically ranges from a few hundred to several thousand dollars, depending on the vehicle's value and the lender's policies. This type of loan is particularly beneficial for those who may not qualify for traditional loans due to poor credit scores or lack of credit history.

Neighborhood Title Loans are becoming an increasingly popular choice for individuals seeking fast financial assistance. Whether you're facing unexpected expenses, medical bills, or urgent home repairs, these loans provide a viable solution that allows you to leverage the value of your vehicle while retaining its use. This comprehensive guide will delve into the benefits, application process, and considerations of neighborhood title loans to help you make an informed decision.

#### Understanding Neighborhood Title Loans

Neighborhood title loans are secured loans that use your vehicle's title as collateral. This means that you can borrow a sum of money based on the equity of your car, truck, or motorcycle. The amount you can borrow typically ranges from a few hundred to several thousand dollars, depending on the vehicle's value and the lender's policies. This type of loan is particularly beneficial for those who may not qualify for traditional loans due to poor credit scores or lack of credit history.

#### The Benefits of Neighborhood Title Loans

One of the primary advantages of neighborhood title loans is the speed at which you can access funds. Many lenders offer same-day approvals, allowing you to receive cash within hours of your application. This is particularly important in emergency situations where time is of the essence. Additionally, because the loan is secured by your vehicle, lenders often have more lenient approval criteria compared to unsecured loans.

Another significant benefit is that you can continue to drive your vehicle while repaying the loan. This is a crucial factor for many borrowers who rely on their cars for daily transportation. Furthermore, neighborhood title loans typically involve a straightforward application process. Most lenders require basic information about your vehicle and personal details, making it accessible for anyone in need of quick cash.

#### The Application Process

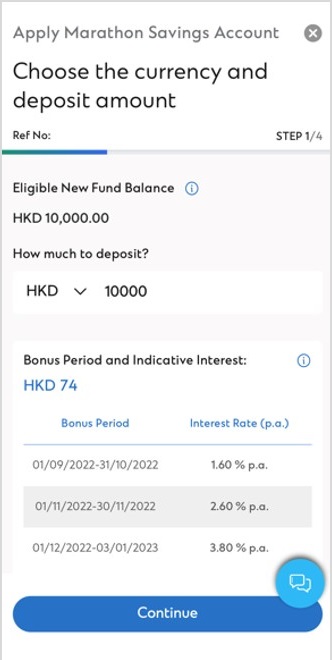

Applying for neighborhood title loans is a relatively simple process. Here’s a step-by-step breakdown:

1. **Research Lenders**: Start by researching local lenders that offer title loans. Look for reputable companies with positive customer reviews and transparent terms.

2. **Gather Documentation**: You will need to provide specific documents, including your vehicle title, proof of income, identification, and sometimes a vehicle inspection.

3. **Complete the Application**: Fill out the application form, either online or in-person, providing accurate information about your vehicle and financial situation.

4. **Vehicle Assessment**: The lender will assess your vehicle's value, which will determine the loan amount you qualify for.

5. **Receive Your Funds**: Once approved, you’ll sign the loan agreement, and the lender will provide you with the funds, usually in cash or through direct deposit.

#### Considerations Before Taking Out a Title Loan

While neighborhood title loans offer numerous benefits, there are also some considerations to keep in mind. First, it’s essential to understand the interest rates and fees associated with these loans. Title loans can carry higher interest rates compared to traditional loans, which could lead to financial strain if you are unable to repay the loan on time.

Additionally, failing to repay your loan could result in the lender repossessing your vehicle. It’s crucial to evaluate your financial situation and ensure that you can meet the repayment terms before taking out a title loan. Always read the fine print and ask questions if anything is unclear.

#### Conclusion

In conclusion, neighborhood title loans can be a lifeline for those in need of quick cash. They offer a fast, accessible way to secure funds using your vehicle's title as collateral. However, like any financial decision, it’s important to weigh the pros and cons, understand the terms, and ensure that you can meet the repayment requirements. By doing your research and choosing a reputable lender, you can take advantage of this financing option while minimizing potential risks. Whether you're facing an emergency or simply need some extra cash, neighborhood title loans may be the solution you've been looking for.