Understanding Nelnet Forgiving Student Loans: A Comprehensive Guide to Loan Forgiveness Options

#### Nelnet Forgiving Student LoansIn recent years, the topic of student loan forgiveness has gained significant attention, especially as millions of borrow……

#### Nelnet Forgiving Student Loans

In recent years, the topic of student loan forgiveness has gained significant attention, especially as millions of borrowers seek relief from their educational debt. One of the key players in this arena is Nelnet, a company that services federal student loans and offers various repayment and forgiveness options. Understanding how Nelnet forgiving student loans works is crucial for borrowers looking to alleviate their financial burdens.

#### What is Nelnet?

Nelnet is a student loan servicer that manages federal student loans on behalf of the U.S. Department of Education. They handle billing, payment processing, and customer service for borrowers. Nelnet plays a vital role in helping borrowers navigate their loan repayment options, including forgiveness programs.

#### Types of Loan Forgiveness Programs

There are several loan forgiveness programs available to borrowers, and Nelnet is involved in administering these options. Some of the most common programs include:

1. **Public Service Loan Forgiveness (PSLF)**: This program is designed for borrowers who work in qualifying public service jobs. After making 120 qualifying monthly payments while working full-time for a qualifying employer, borrowers may have the remaining balance of their Direct Loans forgiven.

2. **Teacher Loan Forgiveness**: Teachers who work in low-income schools or educational service agencies may qualify for forgiveness of up to $17,500 on their Direct Loans or Stafford Loans after five consecutive years of teaching.

3. **Income-Driven Repayment (IDR) Forgiveness**: Borrowers on an IDR plan may have their remaining loan balance forgiven after making payments for 20 or 25 years, depending on the specific plan.

4. **Total and Permanent Disability Discharge**: Borrowers who are totally and permanently disabled may qualify for a discharge of their federal student loans.

#### How to Apply for Forgiveness through Nelnet

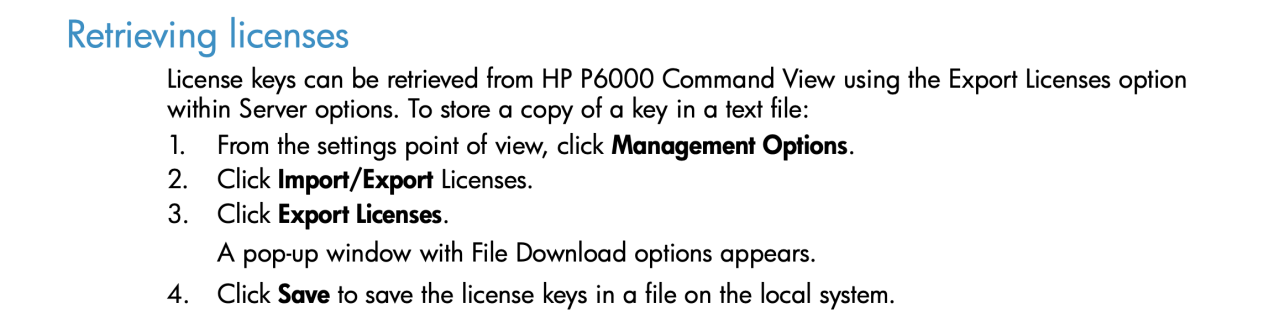

Applying for loan forgiveness through Nelnet involves several steps:

1. **Determine Eligibility**: Before applying, borrowers should assess their eligibility for various forgiveness programs. This may involve reviewing employment history, loan types, and payment history.

2. **Complete the Necessary Forms**: Each forgiveness program has specific forms that need to be completed. For instance, to apply for PSLF, borrowers must submit the Employment Certification Form annually and whenever they change employers.

3. **Submit Documentation**: Along with the forms, borrowers may need to provide documentation to support their application. This could include proof of employment, income, and any other required information.

4. **Stay Informed**: Borrowers should regularly check their Nelnet account for updates on their application status and ensure they are making the required payments to qualify for forgiveness.

#### Challenges and Considerations

While the prospect of loan forgiveness is appealing, borrowers should be aware of potential challenges. The application process can be complex, and many borrowers face difficulties in meeting the eligibility requirements. Additionally, changes in legislation or policies can impact forgiveness programs, making it essential for borrowers to stay informed about their options.

#### Conclusion

Nelnet forgiving student loans offers a pathway to financial relief for many borrowers burdened by student debt. By understanding the various forgiveness programs, eligibility requirements, and application processes, borrowers can take proactive steps towards achieving loan forgiveness. As the landscape of student loans continues to evolve, staying educated and engaged with Nelnet and other resources is crucial for navigating the complexities of student loan repayment and forgiveness.