How Do I Get a PayPal Loan? A Comprehensive Guide to Securing Financing Through PayPal

#### How Do I Get a PayPal Loan?Securing a loan through PayPal can be an appealing option for individuals and small business owners looking for quick and co……

#### How Do I Get a PayPal Loan?

Securing a loan through PayPal can be an appealing option for individuals and small business owners looking for quick and convenient financing. In this guide, we will explore the steps you need to take to understand how to get a PayPal loan, the eligibility criteria, and tips to improve your chances of approval.

#### Understanding PayPal Loans

PayPal offers various financing options, including PayPal Working Capital and PayPal Business Loans. These loans are designed primarily for businesses that process payments through PayPal. The application process is typically straightforward, and funds can be available quickly, making it an attractive choice for urgent financial needs.

#### Eligibility Requirements

Before you ask, "How do I get a PayPal loan?", it’s essential to know the eligibility requirements. Generally, to qualify for a PayPal loan, you must:

1. **Have a PayPal Business Account**: Personal accounts are not eligible for these loans.

2. **Meet Transaction Criteria**: PayPal looks for a minimum number of transactions and sales volume over a specific period.

3. **Be in Good Standing**: Your PayPal account should be in good standing, with no outstanding issues that could affect your eligibility.

#### Application Process

The application process for a PayPal loan is user-friendly. Here’s how to navigate it:

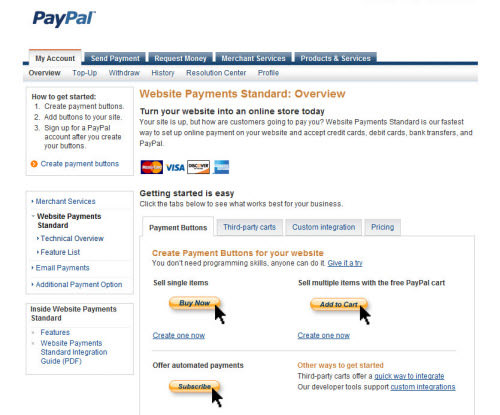

1. **Log into Your PayPal Business Account**: Start by logging into your PayPal account. If you don’t have a business account, you’ll need to create one.

2. **Access the Loan Application**: Once logged in, look for the "PayPal Working Capital" or "Business Loans" section. Here, you can find the option to apply for a loan.

3. **Provide Required Information**: Fill out the application form, which will require information about your business, revenue, and how you plan to use the loan.

4. **Review Loan Offers**: After submitting your application, PayPal will review your information and present you with loan offers. You can choose the one that best fits your needs.

5. **Accept the Loan**: If you find an offer suitable, accept the loan terms, and the funds will typically be deposited into your PayPal account quickly.

#### Tips to Improve Your Chances of Approval

To increase your chances of securing a loan through PayPal, consider the following tips:

- **Maintain a Healthy Transaction History**: Regularly using your PayPal account and maintaining a good transaction history can positively impact your eligibility.

- **Optimize Your Business Profile**: Ensure your business profile is complete and accurate, as this information is crucial during the review process.

- **Prepare Financial Documentation**: While the application is relatively simple, having your financial documents ready can help expedite the process.

#### Conclusion

In summary, understanding "how do I get a PayPal loan?" involves knowing the eligibility criteria, navigating the application process, and preparing adequately to increase your chances of approval. Whether you need funds for inventory, marketing, or other business expenses, PayPal loans can provide a quick and efficient solution. By following the steps outlined in this guide, you can position yourself for success in securing the financing you need through PayPal.