"Understanding Home Equity Loan Duration: How Long Should You Expect Your Loan to Last?"

#### Home Equity Loan DurationHome equity loans have become a popular financial option for homeowners looking to leverage the equity in their properties. Wh……

#### Home Equity Loan Duration

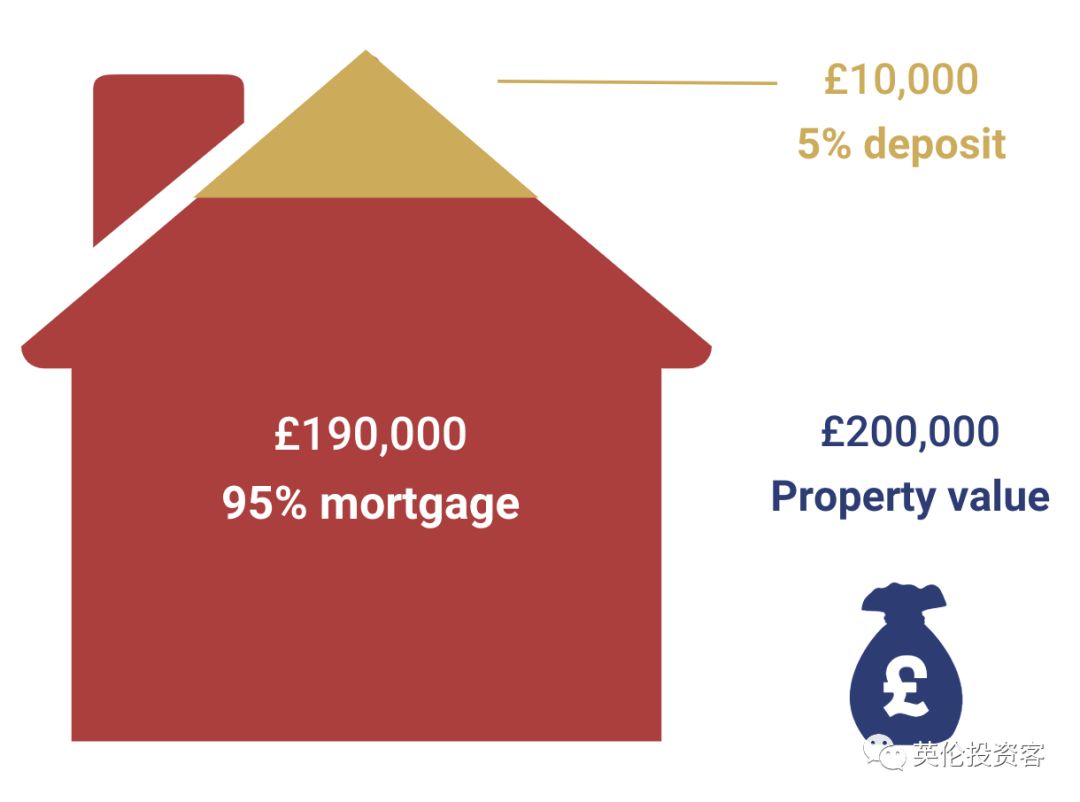

Home equity loans have become a popular financial option for homeowners looking to leverage the equity in their properties. When considering a home equity loan, one of the most critical aspects to understand is the **home equity loan duration**. This term refers to the length of time over which the loan is repaid. Typically, home equity loans come with fixed interest rates and set repayment periods, which can range from 5 to 30 years.

Understanding the implications of **home equity loan duration** is essential for homeowners. A longer duration means lower monthly payments, which can be appealing for those looking to manage their cash flow. However, this also means that you will end up paying more interest over the life of the loan. Conversely, a shorter duration typically results in higher monthly payments but less interest paid overall. Finding the right balance between monthly affordability and total cost is crucial.

#### Factors Affecting Home Equity Loan Duration

Several factors can influence the duration of a home equity loan. The first is the amount of equity you have in your home. Lenders typically allow you to borrow a percentage of your home’s equity, and the more equity you have, the more favorable terms you might receive. Additionally, your credit score plays a significant role; higher credit scores can lead to lower interest rates and potentially shorter loan durations.

Another key factor is your financial goals. If you plan to sell your home in a few years, a shorter loan duration might be more suitable, allowing you to pay off the loan before moving. On the other hand, if you want to keep your monthly payments manageable while accessing cash for home improvements or debt consolidation, a longer duration might be more appropriate.

#### Benefits of Understanding Home Equity Loan Duration

By grasping the concept of **home equity loan duration**, homeowners can make informed decisions that align with their financial needs. Understanding the trade-offs between duration, monthly payments, and total interest paid can help you choose the right loan structure for your situation.

Moreover, being aware of the duration can aid in budgeting and financial planning. Knowing when your loan will be paid off allows you to plan for future expenses or investments. It can also help in determining how long you will be tied to your current financial obligations.

#### Conclusion

In conclusion, the **home equity loan duration** is a vital aspect of the borrowing process that deserves careful consideration. Homeowners must weigh their options and understand how the duration affects their overall financial health. By considering factors such as equity, credit score, and personal financial goals, you can choose a loan duration that best fits your needs. Whether you opt for a shorter or longer term, being informed will empower you to make the best financial decisions for your future.