Understanding the Process of Specialized Loan Servicing Insurance Claim Check: A Comprehensive Guide

Guide or Summary:Introduction to Specialized Loan Servicing Insurance Claim CheckWhat is Specialized Loan Servicing?The Role of Insurance Claims in Loan Ser……

Guide or Summary:

- Introduction to Specialized Loan Servicing Insurance Claim Check

- What is Specialized Loan Servicing?

- The Role of Insurance Claims in Loan Servicing

- Steps in the Insurance Claim Process

- Challenges in the Process

- Best Practices for Homeowners

### Description:

Introduction to Specialized Loan Servicing Insurance Claim Check

The term specialized loan servicing insurance claim check refers to a specific financial process that involves the management and disbursement of insurance claim funds related to loans. This process is particularly significant for homeowners and property investors who have financed their properties through specialized loan servicers. Understanding this process is crucial for anyone involved in real estate financing, as it can greatly affect the financial outcomes of property damage claims.

What is Specialized Loan Servicing?

Specialized loan servicing is a type of financial service that focuses on managing loans that require specific attention due to their unique characteristics. These loans may include those for properties that are in foreclosure, have undergone significant renovations, or are tied to complex financial agreements. The role of specialized loan servicers is to ensure that all aspects of the loan are handled efficiently, including the processing of insurance claims.

The Role of Insurance Claims in Loan Servicing

When a property is damaged due to unforeseen circumstances, such as natural disasters or accidents, homeowners typically file an insurance claim to recover costs. The specialized loan servicing insurance claim check process comes into play when these claims are approved. The servicer must manage the funds received from the insurance company, ensuring they are allocated appropriately to cover repairs or other related expenses.

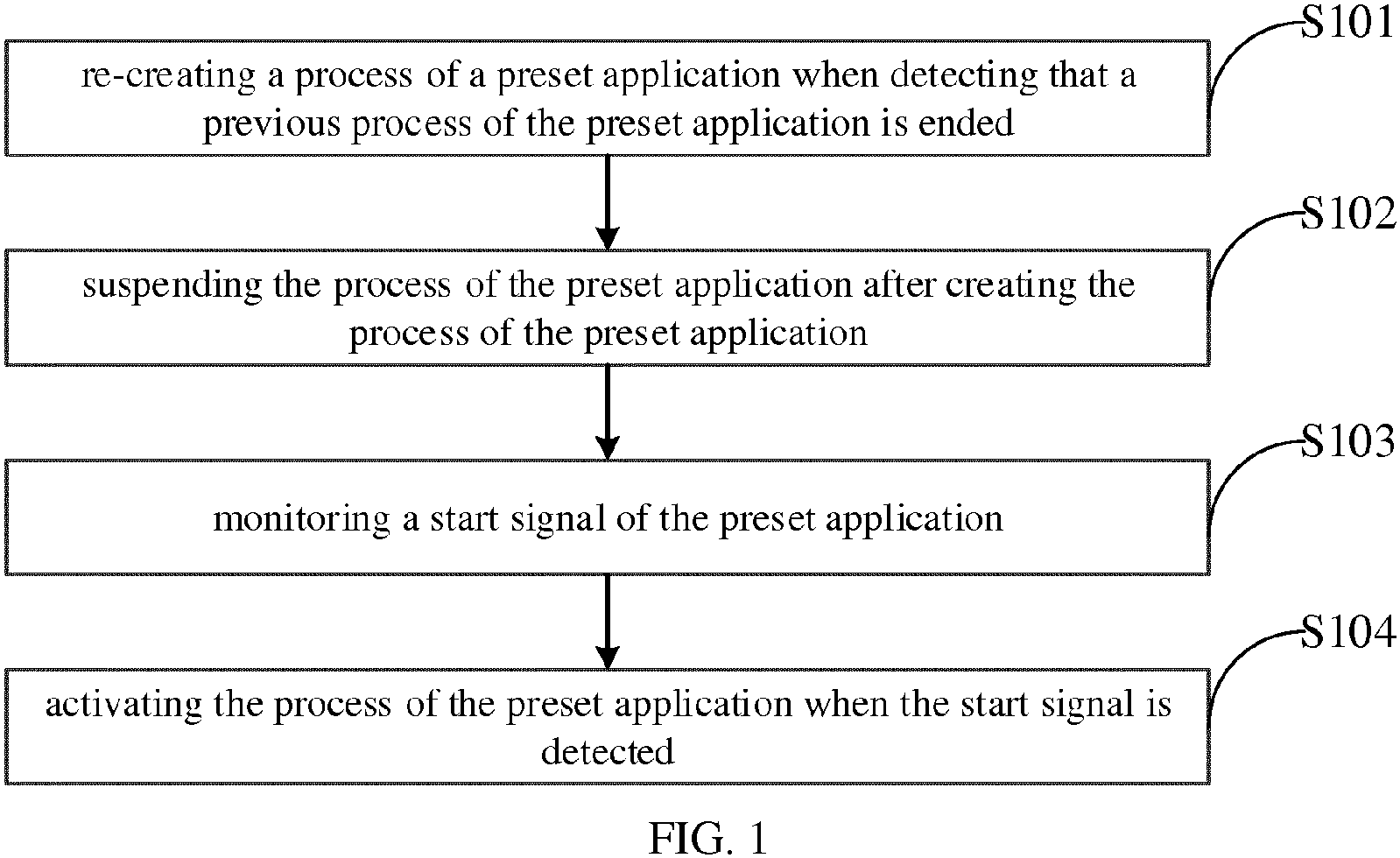

Steps in the Insurance Claim Process

The insurance claim process typically involves several key steps:

1. **Filing the Claim**: The homeowner must file a claim with their insurance company, detailing the extent of the damage.

2. **Claim Assessment**: An insurance adjuster assesses the damage and determines the amount that will be disbursed.

3. **Approval and Check Issuance**: Once approved, the insurance company issues a check, often made out to both the homeowner and the loan servicer.

4. **Check Management**: The specialized loan servicing insurance claim check is then managed by the loan servicer, who ensures that the funds are used for their intended purpose.

Challenges in the Process

Navigating the specialized loan servicing insurance claim check process can present several challenges. Homeowners may face delays in receiving their funds, or there may be disputes over the amount covered by the insurance. It is essential for homeowners to maintain open communication with their loan servicer and insurance company to ensure a smooth process.

Best Practices for Homeowners

To effectively manage the specialized loan servicing insurance claim check process, homeowners should consider the following best practices:

- **Document Everything**: Keep detailed records of all communications with the insurance company and loan servicer.

- **Understand Your Policy**: Familiarize yourself with your insurance policy to know what is covered and what is not.

- **Stay Proactive**: Follow up regularly on the status of your claim and the disbursement of funds.

The specialized loan servicing insurance claim check process is a critical component of property management and financial stability for homeowners. By understanding the steps involved and maintaining clear communication with relevant parties, homeowners can navigate this complex process more effectively. Whether you are a first-time homeowner or an experienced property investor, being informed about this process can help you manage your finances better and ensure that your property is restored efficiently after a loss.